Current State of Tax Credits for Commercial EVs

.jpeg)

.jpeg)

Current State of Tax Credits for Commercial EVs

Like waiting to see if they’d won the lottery, car buyers anxiously waited for April 18th to see how the Federal Government would parse out the EV tax credits provided by the Inflation Reduction Act (IRA). Because the IRA incentives to purchase electric vehicles (EV) come in the form of tax credits, it is the Internal Revenue Service (IRS) that actually decides the details of how that works, and the Internal Revenue Code (IRC) that spells it out for us. Which it did, specifically naming “plug-in electric vehicles” as the target of the incentives.

Much of what we’ve heard and read concerning the “clean vehicle tax credits” has come from the IRC Section 30D. But that section is aimed at passenger vehicles with a gross vehicle weight rating of less than 14,000 pounds and that are not being used for commercial purposes. Business owners exploring tax breaks for commercial vehicles—light, medium, or heavy-duty—must use the IRC Section 45W for guidance.

Commercial Clean Vehicle Credit, IRC Section 45W

According to the IRC Section 45W, “Businesses and tax-exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit of up to $40,000.”

There are caveats in qualifying for tax credits for purchasing commercial electric work trucks and vans, but they are far from the restrictions on retail or passenger vehicles.

According to Andy Koblenz, executive vice president of legal and regulatory affairs at the National Auto Dealers Association (NADA), “The eligibility for the tax credit under 45W does not have as many filters in it, as Congress saw fit to not put as many filters on the commercial one as they did on the 30D.”

What's not present in section 45W as compared to 30D?

- No MSRP cap

- No income cap for the buyer

- No “manufactured in North America” requirements

- No minerals limitation

- No battery component limitations

- No “entity of concern” limitations

Here is a summary of the tax credit stipulations associated with buying commercial EVs:

- Businesses and tax-exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit of up to $40,000. The maximum credit is $7,500 for qualified vehicles with gross vehicle weight ratings (GVWRs) of under 14,000 pounds and $40,000 for all other vehicles.

- The credit equals the lesser of 15% of your basis in the vehicle (30% if the vehicle is not powered by gas or diesel) or the maximum credit of $40,000 for all other vehicles.

- The vehicle must be made by a qualified manufacturer as defined in IRC 30D (current list of qualified manufacturers), be for use in your business, not for resale, and be for use primarily in the United States.

- The vehicle must be subject to a depreciation allowance, with an exception for vehicles placed in service by a tax-exempt organization and not subject to a lease.

- There is no limit on the number of credits your business can claim. However, the credits are nonrefundable, so you can't get back more on the credit than you owe in taxes.

- A 45W credit can be carried over as a general business credit.

Clean Vehicle Credit for Used Vehicles

Published rulings for used EVs are a good news-bad news situation for business owners. The good news is that there are tax incentives for buying used vehicles. The bad news is that they are geared towards passenger vehicles, i.e., “If you buy a qualified used electric vehicle (EV) or fuel cell vehicle (FCV) from a licensed dealer for $25,000 or less, you may be eligible for a used clean vehicle tax credit (also referred to as a previously owned clean vehicle credit). The credit equals 30% percent of the sale price up to a maximum credit of $4,000.”

However, since this credit does have the limit of a gross vehicle weight rating of fewer than 14,000 pounds, plus an income cap, and several other caveats, it makes it difficult for business owners to take full advantage of these used EV credits.

Clean Vehicle Credit for Leased Vehicles

Many business owners lease vehicles rather than purchase them for various reasons. So, for them, it’s a question of whether 45W applies to the consumer leasing process.

Although section 45W doesn’t specifically mention leasing, Question 5 of the IRS page, “Topic G — Frequently Asked Questions About Qualified Commercial Clean Vehicles Credit”, does;

“Q5. Is a taxpayer that leases clean vehicles to customers as its business eligible to claim the qualified commercial clean vehicle credit? (added December 29, 2022)

A5. Whether a taxpayer can claim the qualified commercial clean vehicle credit in its business depends on who is the owner of the vehicle for federal income tax purposes. The owner of the vehicle is determined based on whether the lease is respected as a lease or recharacterized as a sale for federal income tax purposes.”

Good news for companies buying and leasing commercial vehicles. But what about the business owners who lease them? Some leasing companies claim the tax credits and then pass the savings on to consumers.

“In a consumer lease, the vehicle is actually purchased by the leasing company and is depreciated by the leasing company and then is offered through the dealer to the consumer under a lease arrangement,” explains Koblenz. “There are a number of lenders offering lease incentive programs where either the capitalized cost is incentivized down by $7,500, or sometimes the residual value is pushed up by $7,500. Those are two of the paths [for lenders] to create a more attractive lease program.”

Another exciting aspect of this arrangement is that neither the dealer nor the business owner leasing a vehicle will have to worry about filing requirements to benefit. The lending institution handles all that.

Tax incentives are also relevant in the context of leasing used vehicles.

“We've noticed there's not a lot of used vehicle leasing in the market today,” notes Koblenz. “But there's nothing in 45W that limits its application to new vehicles. As long as there was no new vehicle tax incentive—a 30D tax incentive—taken on the vehicle, it appears that the 45W incentive can be taken by a leasing company that is acquiring and leasing a used vehicle. So we may see down the road a very effective tool to get used EVs into the marketplace further, which will, of course, create more room for new EVs to come in behind them.”

The Final Word?

Although these regulations were published on April 18, 2023, and are in effect, they are still a ‘notice of proposed rulemaking’ and not a ‘final rule’.

“There is a period for comments from the public and from industry,” explains Kristin Dziczek, a policy advisor at the Federal Reserve Bank of Chicago in Detroit. “The comment period ended on June 16th. At some point, there will be an interim final rule and eventually a final rule.

“There's still a lot of steps to go through, and a lot can change before all is said and done. There are still many unanswered questions, and what the final regulations will look like and what guidance can consumers rely on when the rules are a little bit in shift.”

The IRS also publishes a FAQ About Qualified Commercial Clean Vehicles Credit page to assist business owners in exploring ways to defray the cost of buying an EV.

Fortunately, most dealers, leasing companies, and lenders are deeply involved and at the leading edge of which vehicles qualify and how to take advantage of the applicable credits. Between your accountant, dealer, and lender, most of this is figured out for you. Which is a good thing because this train doesn’t appear to be slowing down any time soon.

Published on: August 21, 2023 Work Truck Week 2025: Examining the Trajectory of Commercial Vehicle Innovation

Work Truck Week 2025: Examining the Trajectory of Commercial Vehicle Innovation The "Messy Middle" of Zero-Emission Commercial Vehicle Adoption

The "Messy Middle" of Zero-Emission Commercial Vehicle Adoption 4 Gen Logistics: Leading the Charge Towards Zero-Emission Freight

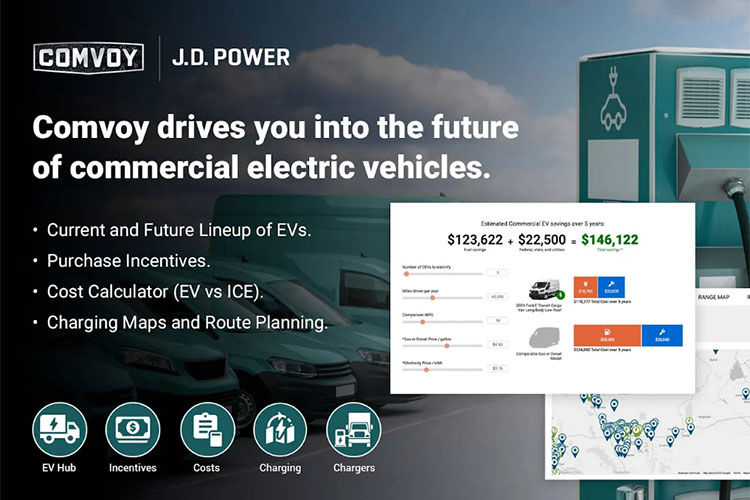

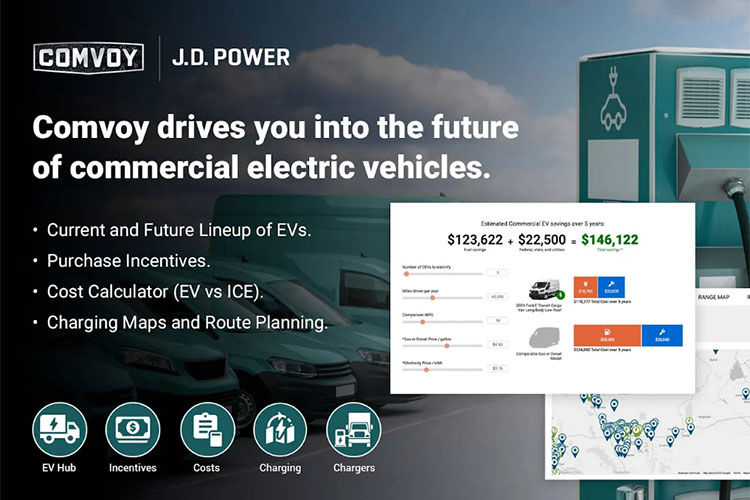

4 Gen Logistics: Leading the Charge Towards Zero-Emission Freight Work Truck Solutions and J.D. Power Launch Commercial EV Hub

Work Truck Solutions and J.D. Power Launch Commercial EV Hub The Cost Benefits of Propane Autogas for Commercial Fleets

The Cost Benefits of Propane Autogas for Commercial Fleets