Class 2b-3 Commercial Vehicles: Where We Are and Where We’re Going

Class 2b-3 Commercial Vehicles: Where We Are and Where We’re Going

Original equipment manufacturers (OEMs), body manufacturers, suppliers, and users of class 2b-3 commercial vehicles are facing rising complexities to meet changing industry demands while also complying with tightening emissions requirements. Navigating these challenges requires an understanding of customer requirements based on many possible use cases.

It’s a complicated web that manufacturers such as the Big 3—Ford, GM, and Stellantis/Ram—body manufacturers and suppliers must plot a course through. To be successful, they must find the right balance across supply and demand, emissions compliance, and offering innovative solutions.

To help industry stakeholders, we provide an overview of the current state of the class 2b-3 commercial vehicle market in this blog, which lays the foundation for Part 2 that focuses on where the class 2b-3 commercial vehicle market is headed, includes an assessment of future emissions regulations, and offers recommendations to help you stay competitive.

Where We Are Now

How Customers Are Currently Using Class 2b-3 Commercial Vehicles

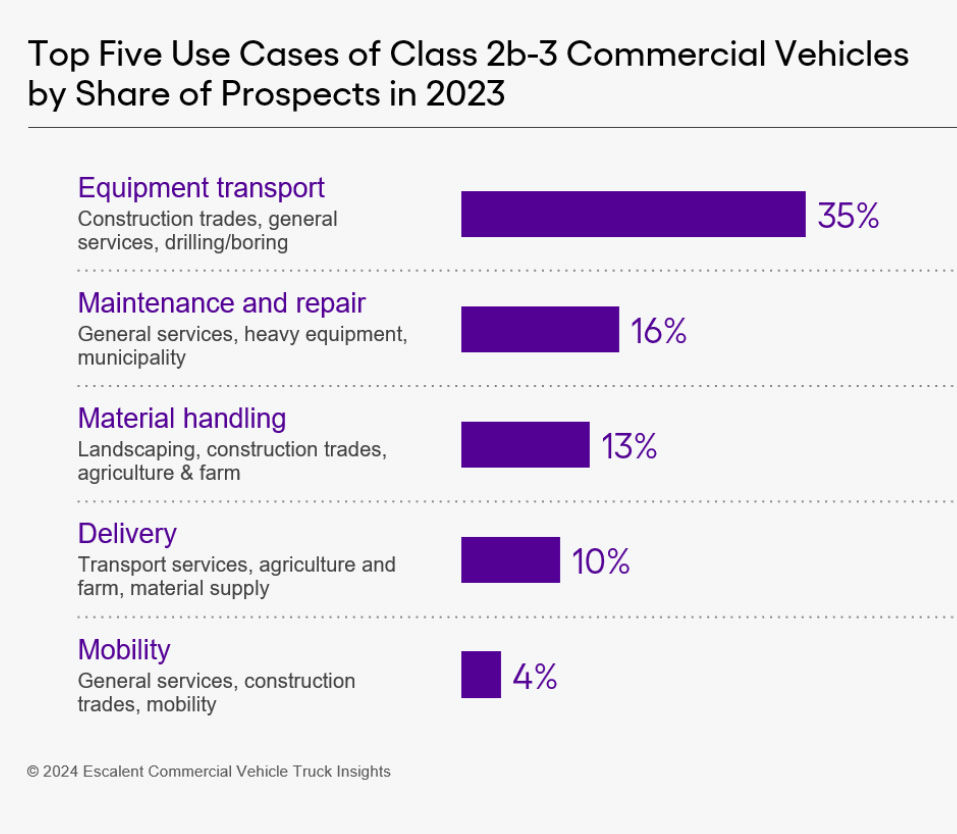

From equipment transport and material handling to delivery and mobility, class 2b-3 commercial vehicles serve a variety of use cases that companies must understand to ensure proper market fit.

To illuminate the top use cases and supporting vehicle types, Escalent, in cooperation with Work Truck Solutions, analyzed website data from Work Truck Solutions’ Comvoy.com searchable online marketplace for work-ready trucks. These data and insights are part of our first-of-its-kind solution, Commercial Vehicle Truck Insights, which unifies current and future vehicle supply, demand, inventory and sales data into a holistic view so OEMs and body manufacturers can produce vehicles that perform end-users’ intended tasks most efficiently.

For example, in 2023, equipment transport took the top spot in share of prospects, primarily serving construction, general services, and drilling industries. While delivery for transport services, agriculture and material supply sits toward the bottom of the list, it’s the use case in which we see the biggest opportunity for electric vehicles (EVs) due to predetermined, locally planned routes well within the vehicles’ battery range.

All of these use cases require different body types and different vehicle configurations, which we’ll explore next.

Preferred Body Types and Body Manufacturers

Post-COVID-19, body manufacturers have experienced strong growth and profitability, with many increasing their investment in R&D and innovation to meet customer demand for productivity and ease of use. We expect to see increased consolidation of these companies by 2030, which will drive further innovation in the market.

In 2023, the most sought body type for the use cases above included service truck, service utility truck, flatbed truck and box van. Knapheide was the preferred body company for customers buying service trucks, service utility trucks and flatbed trucks.

Top Four Body Types and Key Body Manufacturers of Class 2b-3 Commercial Vehicles by Share of Prospects in 2023

Body Type | Key Body Manufacturers |

Service truck | Knapheide, Reading, Royal Truck Body, Scelzi, Harbor, Monroe Truck Equipment |

Service utility truck | Knapheide, Reading, Rockport |

Flatbed truck | Knapheide, CM Truck Beds, Bedrock, Scelzi, PJ’s Truck Bodies, Blue Ridge, Manufacturing (Freedom), M.H. EBY |

Box van | Rockport, Supreme, Bay Bridge, Unicell, Morgan Truck Body, Utilimaster |

Source: 2024 Escalent Commercial Vehicle Truck Insights

Vehicle Chassis Types That Top the Demand List

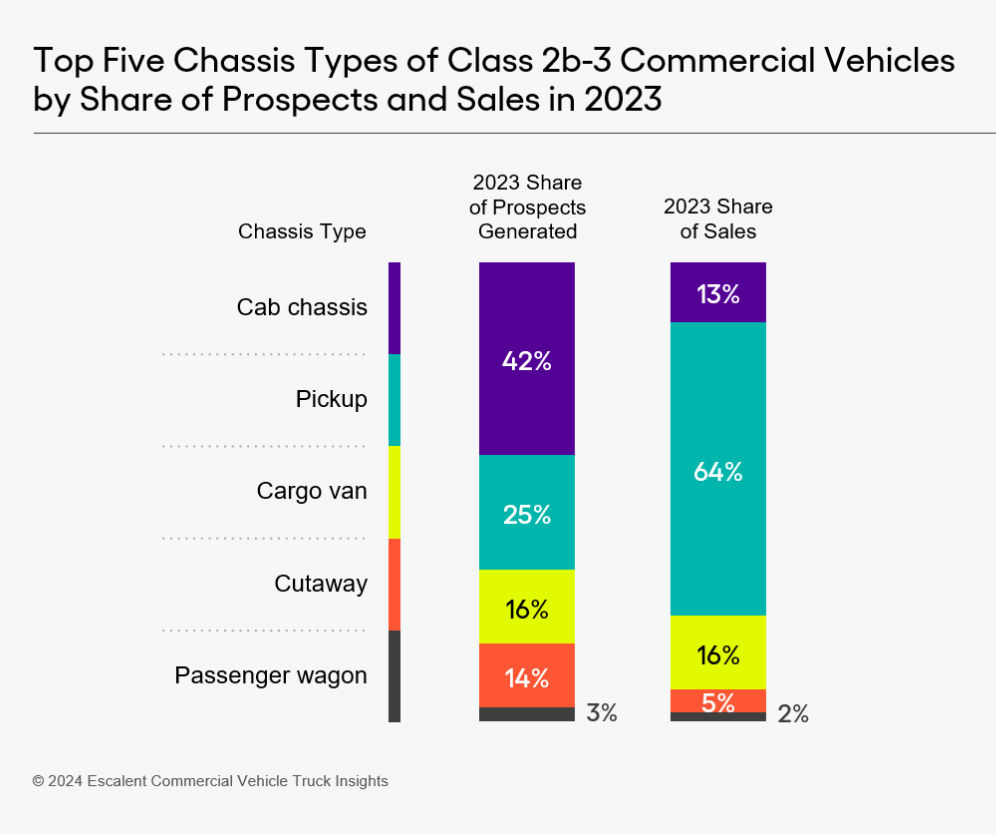

In 2023, cab chassis, pickup, cargo van, cutaway and passenger vans were the most frequently considered vehicle chassis. These types play important roles in various industries, each serving specific functions and providing unique benefits:

- Cab chassis are preferred for reliability and ease of upfit in industries such as construction, services, drilling and boring, agriculture, landscaping, and material handling and sales.

- Pickup trucks are popular for their versatility in construction, landscaping, services, and agriculture.

- Cargo vans are commonly used in construction trades, transport services, material delivery, and sales and services. With a wide range of lengths and heights, cargo vans provide indispensable transport services, facilitating the movement of goods, services and passengers.

- Cutaway chassis vehicles are commonly used in construction, agriculture, transport services, material handling and sales, and passenger transport industries.

- Passenger vans are crucial for mobility and passenger transport needs, especially for shuttle buses and private hire operations.

In the following chart, you can see the share of prospects versus sales for each of these chassis types.

Cab chassis and cutaways have a much higher share in prospects compared with sales due to requirements for specific body types and longer lead times, while pickups are the top-selling chassis due to easier availability right off the dealer’s lot. Because cargo vans have a range of body styles, they can often be sold as received from the OEM, although some require modifications to fit their intended use. As such, the share of prospects and sales for this type are closely aligned.

OEMs Leading the Commercial Vehicle Class 2b-3 Market

As the leading commercial vehicle manufacturer, Ford leads the van and cutaway segments, and along with GM (including BrightDrop) and Stellantis/Ram, these Big 3 brands have a strong hold over the segment with presence across multiple product categories.

Isuzu, with its chassis cab, and Mercedes Benz, with its Sprinter van models, are the only other traditional manufacturers participating in the segment. Start-ups, including Mullen, Rivian and Vicinity Motors, have recently entered or have plans to enter the class 2b-3 market, while Nissan has announced it will discontinue its Titan series and exit the segment.

Service truck bodies are the predominant body type of interest for customers shopping the Big 3 OEMs, followed by service utility vans and flatbed trucks. This is directly proportional to the popularity of cab chassis and cutaways in the prospects for this segment.

Finally, specialized upfitted vehicles emerge as top requirements from potential buyers, including mechanic service trucks for sale, which meet diverse operational needs.

OEMs’ Product Portfolio of Class 2b-3 Commercial Vehicles by Chassis Type

OEM | Pickup | Cargo Van | Chassis Cab | Cutaway | Passenger Wagon |

Ford | X | X | X | X | X |

GM (including BrightDrop) | X | X | X | X | X |

Isuzu | X | ||||

Mercedes-Benz | X | X | X | ||

Mullen | X | ||||

Nissan | X | ||||

Rivian | X | ||||

Stellantis | X | X | X | X | |

Vicinity Motors | X |

Source: 2024 Escalent Commercial Vehicle Competitive Landscape—Powertrain Build Plan

What’s Next for Class 2b-3 Commercial Vehicles

Now that you’re up-to-date on the current state of the class 2b-3 commercial vehicles market, don’t miss Part 2 of this blog series, coming out soon, to find out more about where the market is heading. You’ll learn:

- How new EPA guidelines provide flexibility for OEMs to meet emission guidelines

- What customers will be looking for in class 2b-3 commercial vehicles in the future

- Recommended actions you can take now to help you stay competitive

Reach out to us with any questions or to learn more about how our commercial vehicle and fleet experts can provide you with a holistic view of current and future commercial vehicle supply, demand, inventory and sales data for more accurate and effective product and strategic planning.

Originally published on the Escalent blog. Authors: Mike Eaves, Paritosh Gupta, Shashwat Mishra.

Published on: September 06, 2024 Work Truck Week 2025: Examining the Trajectory of Commercial Vehicle Innovation

Work Truck Week 2025: Examining the Trajectory of Commercial Vehicle Innovation The "Messy Middle" of Zero-Emission Commercial Vehicle Adoption

The "Messy Middle" of Zero-Emission Commercial Vehicle Adoption 4 Gen Logistics: Leading the Charge Towards Zero-Emission Freight

4 Gen Logistics: Leading the Charge Towards Zero-Emission Freight Work Truck Solutions and J.D. Power Launch Commercial EV Hub

Work Truck Solutions and J.D. Power Launch Commercial EV Hub The Cost Benefits of Propane Autogas for Commercial Fleets

The Cost Benefits of Propane Autogas for Commercial Fleets