Class 2b-3 Commercial Vehicles: How the Industry Can Find the Right Balance Across Supply, Demand, and Emissions Requirements

Class 2b-3 Commercial Vehicles: How the Industry Can Find the Right Balance Across Supply, Demand, and Emissions Requirements

In Part 1 of this mini blog series, we dove into the current state of the class 2b-3 commercial vehicles market, including how customers are using these vehicles, the preferred body types and body manufacturers, most frequently considered chassis types, and which original equipment manufacturers (OEMs) are leading the market.

In this blog, we’ll cover where the market is headed, explore important considerations around the recently published Environmental Protection Agency (EPA) regulations, and uncover what customers will be looking for when buying class 2b-3 vehicles in the future.

Through this two-part series, you’ll walk away with a comprehensive view of supply, demand and emissions insights to help you strengthen your strategic and product planning, and get ahead of the competition.

What’s Next for Class 2b-3 Commercial Vehicles

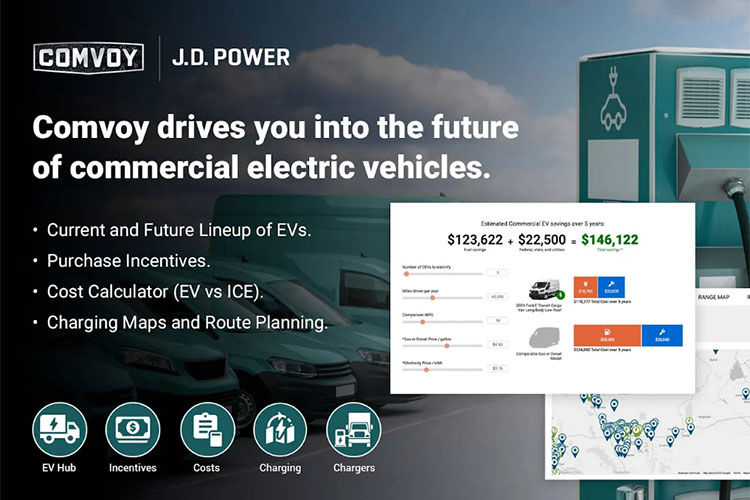

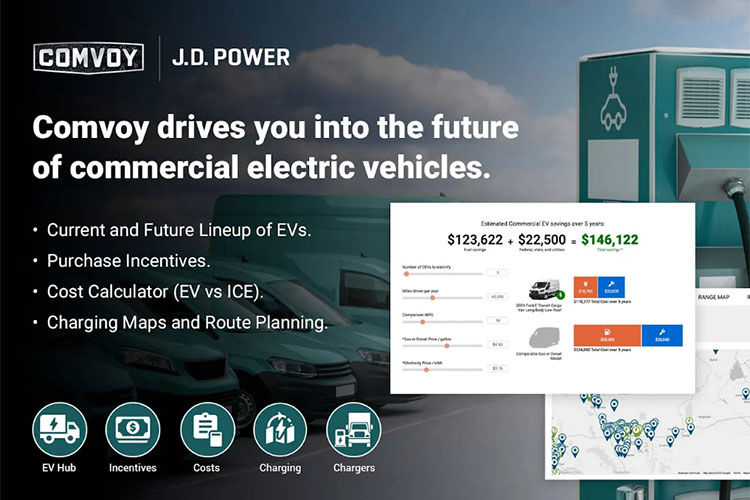

As with the data and insights we presented in Part 1, this blog includes data from our Commercial Vehicle Truck Insights solution, the first of its kind. This solution incorporates Escalent analysis of website data from Work Truck Solutions’ Comvoy.com searchable marketplace for work-ready trucks, which provides insight into commercial vehicle shopper interest.

Moving forward, we expect to see the below four key developments emerge in the class 2b-3 commercial vehicle space between now and 2032:

1. E-commerce delivery tops growth prospects

Delivery is expected to be the fastest growing use case through the end of the decade, while body types such as service trucks, service utility van, box van, flatbed, crew van and passenger van will sustain growth. In addition, demand for chassis cabs, cutaways, cargo vans and passenger vans is expected to grow rapidly in the short term and then slow in the medium- to long-term, while demand for pickups will fall slightly through the end of the decade.

Growth Outlook for Key Deployment Industries of Class 2b-3 Commercial Vehicles

| Industry | Use Cases | Growth Prospect | Source |

| E-commerce | Delivery | High | Per eMarketer, the US e-commerce industry is expected to reach 1.7 trillion USD by 2027 |

| Construction trades | Equipment transport, material handling, mobility, services | Medium | According to the FMI, US construction spending is forecast to grow at a CAGR of 3.9% from 2022 to 2027 |

| General service | Equipment transport, maintenance and repair, mobility | Low | According to the Bureau of Labor Statistics (BLS), installation, maintenance and repair occupations are expected to have 228,000 more employees over the next decade |

| Agriculture and farm | Maintenance and repair, material handling, mobility, heavy hauling/trailering | Low | According to the OECD-FAO Agricultural Outlook 2023-32, North America’s agriculture and farming output is expected to grow at a CAGR of 1.4% from 2022 to 2032 |

2. Relaxed EPA regulations will provide flexibility for OEMs to meet emissions requirements

While zero emissions is still the goal, new EPA guidelines published in March 2024 enable manufacturers to choose between advanced internal combustion engine (ICE) and zero-emission vehicle (ZEV) technologies to lower emissions, enabling the industry to take a more gradual approach to reducing emissions and presenting big opportunities for hybrid vehicles. Applicable to vehicles for model years (MY) 2027–2032, the new standards are expected to result in a 44% reduction in projected fleet average emissions in 2032 compared with 2026.

Despite the push for zero emissions, gasoline and diesel engines will still be around in 2030, with gasoline engines increasing due to favorable cost base and the ability to meet emissions requirements more easily than diesel. Hybrids will emerge as a viable alternative to electrification, and the extension of carbon credits programs for hybrids beyond 2027 will make them more attractive to manufacturers and vehicle buyers.

The approach to meeting emission standards—whether through hybridization or electrification—will also be strongly determined by use cases, use patterns, available infrastructure and adoption rates. For instance, passenger vans, box vans and crew vans lend themselves better to electric powertrains due to local use patterns and controlled environments. These vehicles run mostly on predetermined routes and return to base at the end of the day, reducing the risk of critically low battery levels and ensuring optimum battery recharging at depots overnight. Therefore, we expect higher electrification levels in the van segment for last-mile, localized delivery use cases. In fact, this segment presents the best opportunity for electrification out of all class 2b-3 segments.

On the other hand, service trucks, service utility vans and flatbeds are better suited to hybridization as their operating conditions and technical requirements are varied. These use cases often require higher payload, towing and power takeoff capabilities, which are currently better suited for ICE and hybrid vehicles. This is why we expect to see more hybridization in chassis cabs and pickups.

3. Customers will demand commercial vehicles built for productivity and ease of use

Upfitting will take center stage as customers look for vehicles they can use as mobile workspaces where everything is within reach. Body manufacturers will work to make vehicles such as vans, utility and service vehicles as operationally efficient and practical as possible with innovative racks and shelving to hold tooling, and expandable work surfaces for workshop environment designs.

This will benefit users such as HVAC contractors, electrical contractors and home contractors who require a mobile workstation that can help them improve efficiencies and gain capabilities such as fabricating parts onsite.

4. Connected services will become an important requirement in commercial vehicles

As commercial fleets seek more efficiency in their route planning and driving patterns, internet-enabled connected vehicle services can enable a better connection with their vehicles and drivers, providing valuable insights into routes and driver behavior. Therefore, these technologies will become an important value driver in the coming years. More OEMs will focus on developing connected vehicle services as part of their fleet offerings to meet this demand and generate new revenue streams in the process. For example, Ford Pro offers connected solutions that communicate operating data to customers, including alerts for charging an electric vehicle, route plans to avoid EVs running out of range, gas or diesel powertrain alerts, as well as fuel economy and maintenance alerts. Stellantis has also recently announced a similar suite of services under its Ram Professional solution.

Other connected vehicle services customers are asking for include the ability to download invoices and take credit cards onsite to quickly complete transactions anywhere. These connected services not only provide visibility into the use cycle of the vehicle, but also save costs and increase efficiencies.

Recommendations for Class 2b-3 Commercial Vehicle OEMs, Body Companies and Suppliers to Stay Competitive

- Understand vehicle use cases and customer needs: Familiarize yourself with how vehicles are being used and upfit in the field and what attributes businesses are looking for so you can ensure you provide products and services that fulfill customer needs.

- Get to know the competitive landscape: Identify trends—including how competitors spec and configure vehicles—so you can take strategic action to meet the changing demands. Entrants can compete by entering the market with electric vehicles and possibly partnering with body companies to break into niche segments.

- Tune into the customer journey: Get a better understanding of how buyers shop, including vehicle interest, consideration, inventory and sales trends.

- Be aware of changing EPA regulations: Be sure to keep track of and stay up-to-date on the latest industry news and developments to ensure compliance when developing new products and services.

Get in touch using the below form to learn more about how our commercial vehicle and fleet experts can help you gain a comprehensive view of current and future commercial vehicle supply, demand, inventory and sales data for more accurate and effective product and strategic planning.

Originally published on the Escalent blog. Authors: Mike Eaves, Paritosh Gupta, Shashwat Mishra.

Published on: October 03, 2024How Efficient Upfit Planning Amplifies The ROI of Your Commercial Vehicle Upfit

Innovations for National Distracted Driving Awareness Month

Innovations for National Distracted Driving Awareness Month Work Truck Week 2025: Examining the Trajectory of Commercial Vehicle Innovation

Work Truck Week 2025: Examining the Trajectory of Commercial Vehicle Innovation Work Truck Solutions and J.D. Power Launch Commercial EV Hub

Work Truck Solutions and J.D. Power Launch Commercial EV Hub The Cost Benefits of Propane Autogas for Commercial Fleets

The Cost Benefits of Propane Autogas for Commercial Fleets